Lucrative

Quick to access and simple to use, wherever you are. One document is all that's needed

Quick to access and simple to use, wherever you are. One document is all that's needed

A reliable direct lender with fresh solutions. We protect your information and assist during challenging times

A simple, rapid solution from the comfort of your home. Instant money transfers and flexible loan periods

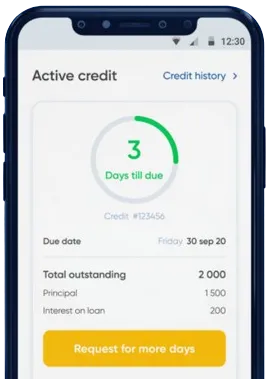

Apply through the app by completing the necessary form.

Stay tuned for a decision, usually ready in 15 minutes.

Obtain your funds, usually taking only one minute to transfer.

Apply through the app by completing the necessary form.

Download loan app

Emergency loan in Kenya are financial products designed to provide individuals with access to quick cash in times of urgent need. These loans are typically offered by banks, microfinance institutions, and online lenders, and can be used for a variety of purposes, such as medical emergencies, unexpected expenses, or temporary cash flow problems.

One of the main benefits of emergency loan in Kenya is their quick approval process. Many lenders offer instant approval for these loans, allowing borrowers to access funds within hours or days of applying. This can be crucial in situations where time is of the essence, such as when facing a medical emergency or urgent financial need.

In addition to their quick approval process, emergency loan in Kenya also offer flexible repayment options. Borrowers can choose repayment terms that suit their financial situation, making it easier to manage the loan and avoid falling into further financial hardship.

Emergency loan can be incredibly useful in helping individuals navigate unexpected financial challenges. Whether facing a medical emergency, sudden job loss, or car repair, these loans can provide the necessary funds to cover expenses and ease the financial burden. In many cases, emergency loan can mean the difference between financial stability and financial distress.

Furthermore, emergency loan can help individuals avoid more expensive forms of credit, such as payday loans or credit card cash advances. By providing access to quick, affordable financing, these loans can help borrowers avoid high interest rates and excessive fees.

Before applying for an emergency loan in Kenya, it is important to carefully consider the terms and conditions of the loan, including interest rates, repayment terms, and any additional fees. Borrowers should also assess their ability to repay the loan on time to avoid falling into a cycle of debt.

Emergency loan in Kenya can be a valuable financial tool for individuals facing unexpected expenses or financial challenges. With their quick approval process, flexible repayment options, and accessibility to individuals with poor credit, these loans can provide much-needed financial relief in times of crisis. However, it is important for borrowers to carefully consider the terms and conditions of the loan before applying to ensure that they can afford the repayments and avoid further financial hardship.

An emergency loan is a short-term loan that is designed to provide quick financial assistance to individuals facing urgent financial needs or unexpected expenses.

Anyone who is a Kenyan citizen or resident with a regular source of income can apply for an emergency loan in Kenya. Some lenders may have specific eligibility criteria, so it is advisable to check with individual lenders.

Many lenders in Kenya offer quick approval and disbursement of emergency loan, with some providing funds within 24 hours of application approval. However, the processing time may vary depending on the lender and the documentation provided.

The repayment period for an emergency loan in Kenya is usually short-term, ranging from a few weeks to a few months. It is essential to review the terms and conditions of the loan agreement to understand the repayment schedule.

Most emergency loan in Kenya are unsecured, meaning that they do not require collateral. However, some lenders may request collateral for larger loan amounts or for individuals with a lower credit score.

Interest rates for emergency loan in Kenya vary among lenders and may depend on factors such as the loan amount, repayment period, and the borrower's creditworthiness. It is important to compare rates from different lenders to find the most affordable option.